Horizontal and Vertical Analysis

This can be done to all other accounts to find what percentage of total assets each account is. For example a business may want to know how much inventory contributes to total assets.

Quickbooks Horizontal Vertical Analysis Quickbooks Analysis Horizontal

Shareholder equity divided by total.

. The primary differences between horizontal and vertical analysis include. However it is important to note. Two measures of vertical analysis- 1.

This can help a business to know how much of one item is contributing to overall operations. In turn horizontal analysis shows that over the year the share of fixed assets increased by 6 ie. To prepare a vertical analysis you select an account of interest comparable to total revenue and express other balance sheet accounts as a percentage.

While horizontal analysis refers to the comparison of financial information such as net income or cost of goods sold between two financial quarters including quarters months or years vertical analysis involves the analysis of financial data independent of time and the co-relation of items relating to a companys financial information and how t. A technique often used both with ratio analysis and vertical analysis is benchmarking which computes common-size financial statements or financial ratios and compares them with other companies and industry standards. In the case of horizontal analysis the line by line method is adopted.

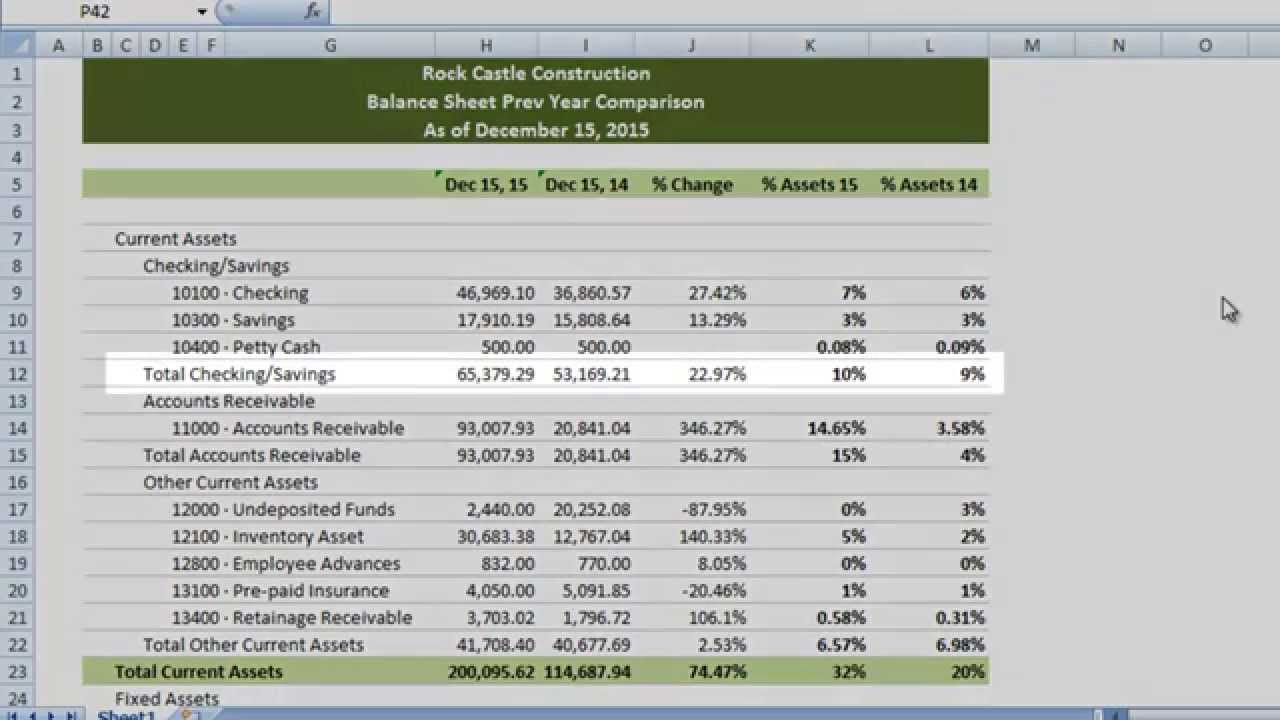

Documents For Your Business Vertical analysis helps in understanding the composition of various components such as expenses cost of goods sold liabilities and assets. Vertical analysis is used to analyze a companys financial statement information within an accounting period. Example of Vertical Analysis of a Balance Sheet If a companys inventory is 100000 and its total assets are 400000 the inventory will be expressed as 25 100000 divided by 400000.

The vertical analysis of an income statement results in every income statement amount being restated as a percent of net sales. 1 Vertical analysis can become a more potent. Below is the example of percentages of total assets that the current assets and shareholder equity make up.

This is different from horizontal analysis which compares across years. Horizontal analysis is performed horizontally across time periods while vertical analysis is performed vertically inside of a column. The key difference between horizontal and vertical analysis is the process of extraction of financial data from financial statements.

Horizontal analysis compares financial information for one company with the same types of financial income for the same company in one or more previous years. So while horizontal analysis is a dynamic way of looking at data vertical analysis deals with the static details. Vertical Analysis The primary difference between vertical analysis and horizontal analysis is that vertical analysis is focused on the relationships between the numbers in a.

As of 31122020 44. Production has become more capital intensive. Given these descriptions the main difference between vertical analysis and horizontal analysis is that vertical analysis is focused on the relationships between the numbers in a single reporting period while horizontal analysis spans multiple reporting periods.

On the contrary the vertical analysis focuses on comparing each item over a period in the form of ratios. Vertical analysis provides the relative annual changes within an organization while horizontal analysis focuses on the fluctuation of a specific figure during a set time frame. Horizontal Analysis vs.

Horizontal analysis represents changes over years or periods while vertical analysis represents amounts as percentages of a base figure. By contrast a vertical analysis looks only at one year. Generally the total of assets total of liabilities and stockholders equity are employed as base figures with regards to a balance sheet.

Current assets divided by total assets- 4882 31727 6. Vertical analysis compares line items within a statement in the current year. Vertical analysis makes it easier to understand the correlation between single items on a balance sheet and the bottom line expressed in a percentage.

This approach uses one. This technique is popular and is sometimes used to compare a company to its competitors. For example the vertical analysis showed that the share of fixed assets as of December 31 2019 was equal 38 of the total assets of the organization.

What is the difference between vertical and horizontal analysis A horizontal analysis typically looks at a number of years. For a horizontal analysis you compare like accounts to each other over periods of time for example accounts receivable AR in 2014 to AR in 2015. The main difference between vertical and horizontal analysis is that vertical operates up and down the data of one accounting period and horizontal operates across several accounting periods to identify trends.

Difference Between Financial Analysis Business Performance Analysis

Horizontal Analysis Financial Statement Financial Statement Analysis Trend Analysis

Download Balance Sheet Vertical Analysis Excel Template Exceldatapro Financial Statement Analysis Balance Sheet Financial Analysis

Financial Statement Analysis Vertical Analysis Financial Accounting V Financial Statement Analysis Financial Statement Discount Textbooks

Vertical Analysis Common Size Analysis Of Financial Statements Financial Statement Analysis Financial Analysis Financial Statement

Horizontal Analysis Is Financial Analysis Financial Statement Trend Analysis

0 Response to "Horizontal and Vertical Analysis"

Post a Comment